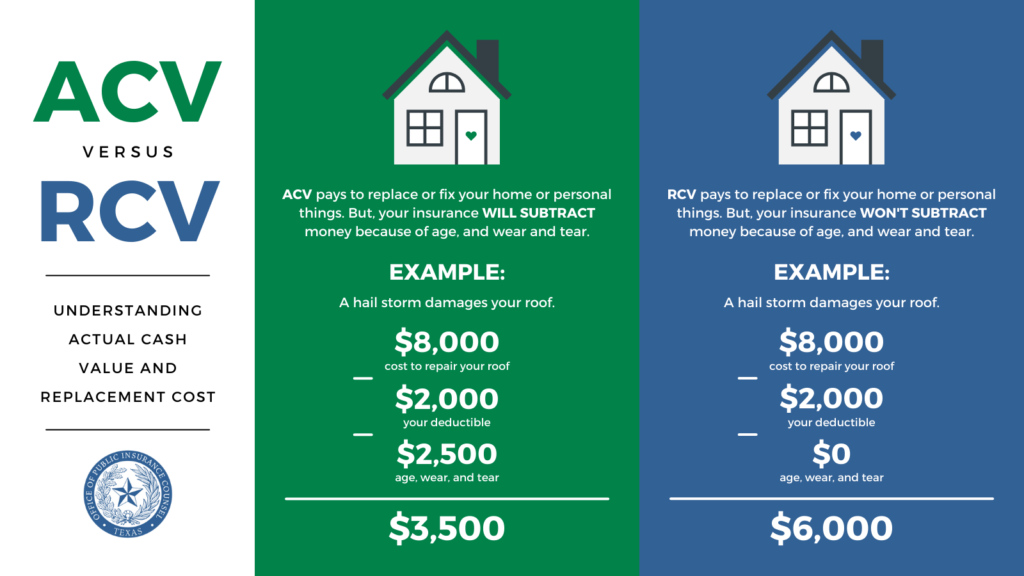

Waiving or absorbing your insurance deductible by roofing companies is both illegal and unethical, as it constitutes insurance fraud. Engaging in such practices can lead to serious consequences for both the contractor and the homeowner, since the deductible represents a binding obligation between you and your insurer. The deductible is a portion of the Actual Cash Value (ACV) of the claim, and it is your responsibility to pay. This amount is not paid to the insurance company because it’s your contribution to restoring your home to its pre-damage condition.

Waiving or absorbing your insurance deductible by roofing companies is both illegal and unethical, as it constitutes insurance fraud. Engaging in such practices can lead to serious consequences for both the contractor and the homeowner, since the deductible represents a binding obligation between you and your insurer. The deductible is a portion of the Actual Cash Value (ACV) of the claim, and it is your responsibility to pay. This amount is not paid to the insurance company because it’s your contribution to restoring your home to its pre-damage condition.

Why is Waiving Deductibles a Concern?

- Insurance Fraud: When companies inflate invoices to cover deductibles, they commit fraud, which can lead to legal consequences.

- Increased Premiums: Unethical practices can lead insurance companies to scrutinize invoices more carefully, potentially resulting in higher premiums for policyholders in the area.

- Impact on Coverage: Waiving the deductible may negatively affect other aspects of your insurance coverage.

Legitimate Strategies to Consider

- Shop Around: Obtaining multiple quotes from various contractors can help you find competitive pricing.

- Negotiate: While you can negotiate for a lower service fee, be aware that the deductible remains your responsibility.

- Explore Financing: Many contractors offer financing options to assist you in managing the cost of the deductible.

- Utilize ACV Credits: Claiming the Actual Cash Value (ACV) of related storm damage, such as gutters or siding, can help effectively offset your roofing deductible.