When dealing with an insurance claim for roof damage, the process can often feel overwhelming, especially if your claim has been denied. This is where the expertise of a public adjuster can be invaluable. Public adjusters are licensed professionals who work on behalf of policyholders to ensure they receive the full compensation they deserve from their insurance companies. Here’s how they can help if your roof claim is denied.

Understanding the Role of a Public Adjuster

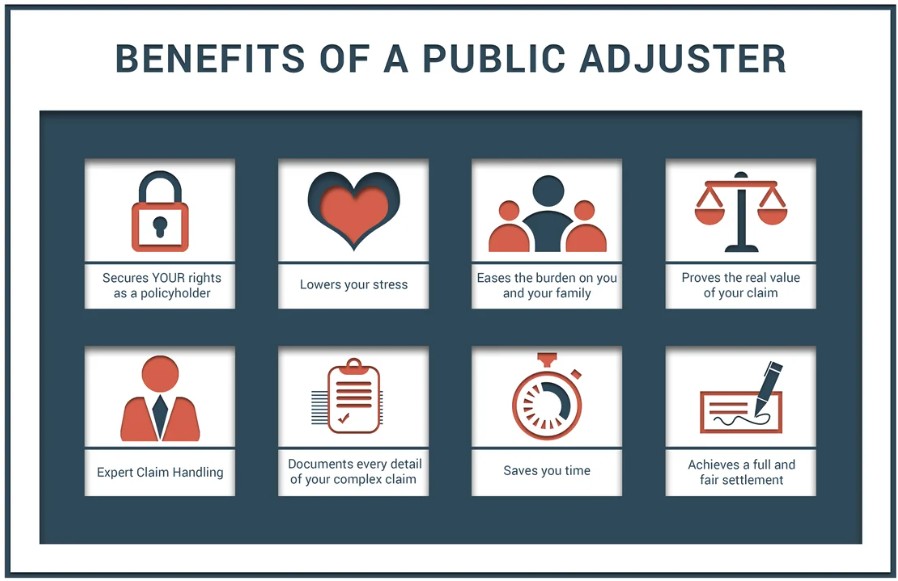

A public adjuster acts as an advocate for the policyholder. Unlike insurance adjusters who work for the insurance company, public adjusters are independent professionals who evaluate claims and negotiate settlements. Their goal is to ensure that you receive a fair and adequate settlement for your losses, including damages to your roof.

Assessing the Damage

If your roof claim was denied, a public adjuster can conduct a thorough evaluation of the damage. They have the expertise to identify issues that may have been overlooked or misrepresented in your initial claim. This includes examining the extent of the damage, documenting the repairs needed, and providing a comprehensive report that can be submitted to the insurance company.

Reopening the Claim

Sometimes, a denied claim can be reopened. A public adjuster understands the appeal process and can help you navigate it efficiently. They know the necessary documentation and arguments that can strengthen your case, making it more likely for the insurance company to reconsider their decision.

Negotiating with the Insurance Company

Once a public adjuster has reassessed your claim and gathered the necessary documentation, they will handle negotiations with the insurance company on your behalf. Their experience in dealing with insurance policies and claims makes them well-equipped to advocate for a fair settlement. They can effectively communicate the details of your case, clarify any misunderstandings, and push for a more favorable outcome.

Reducing Stress

Dealing with a denied insurance claim can be stressful and time-consuming. Hiring a public adjuster allows you to focus on other important matters while they take charge of the claim process. They will manage all communications with your insurance company and ensure that everything is handled professionally.

Maximizing Your Settlement

One of the primary advantages of working with a public adjuster is their ability to maximize your settlement amount. They understand the nuances of your policy and know what to look for to ensure you receive every penny you are entitled to. Their expertise can significantly increase the chances of a successful claim resolution.

Conclusion

If your roof claim has been denied, enlisting the help of a public adjuster can be a smart move. They provide invaluable support by re-evaluating your damages, reopening claims when possible, negotiating settlements, and reducing the stress associated with the claims process. By leveraging their expertise, you can significantly improve your chances of receiving a fair settlement and ultimately getting your roof repaired.